How to Verify a Turkish Supplier Step-by-Step

Supplier Verification Journey

How to Verify a Turkish Supplier Step-by-Step

Introduction: From Opportunity to Strategic Partnership

Turkey stands as a dynamic and strategic sourcing hub for European SMEs. Its proximity to Europe, competitive pricing, and strong manufacturing base in sectors like textiles, automotive, and machinery make it an attractive partner. This potential, however, is coupled with inherent risks that demand a professional, structured risk management strategy.

Challenges such as inconsistent quality, communication breakdowns, and the difficulty of distinguishing genuine manufacturers from unauthorized intermediaries are real. Furthermore, navigating complex EU regulations like the Carbon Border Adjustment Mechanism (CBAM) and the German Supply Chain Act (LkSG) places significant new due diligence obligations on importers. The difference between a successful partnership and a costly failure lies in the exhaustive verification performed before the first order is placed.

This guide provides a structured, seven-step framework used by professional sourcing agents. Its goal is to equip European purchasing professionals to move from assumption to verified fact, transforming a potentially risky venture into a strategic advantage and building a foundation for a reliable, long-term supply relationship.

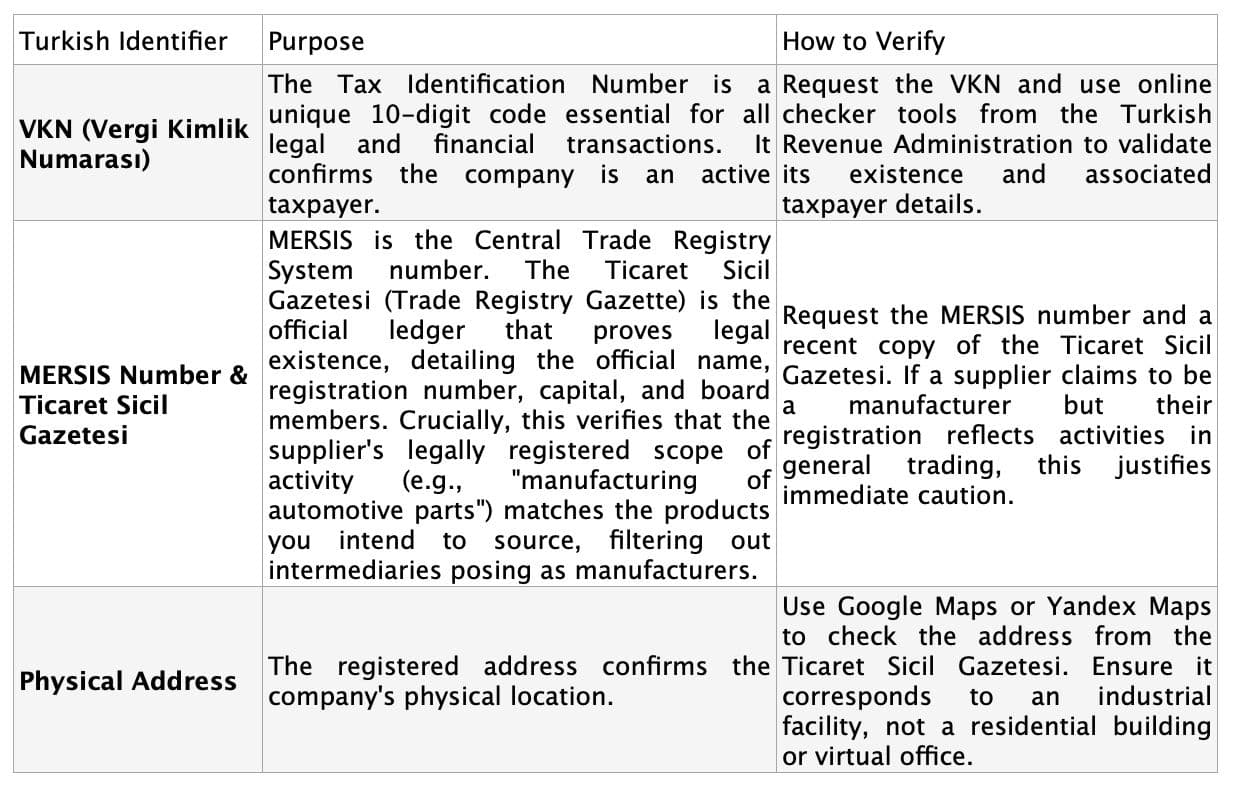

Step 1: Company Legitimacy and Financial Health Check (Desktop Audit)

The first and foundational step is to confirm the supplier is a legally registered, active, and financially stable business entity before any other evaluation. This desktop audit ensures you are dealing with a legitimate counterparty and acts as a critical filter against fraud.

Financial Health Assessment

Assessing financial stability is non-negotiable, as it indicates a supplier's ability to fulfill orders and weather economic fluctuations. Request a commercial credit report from international agencies like Creditsafe, Dun & Bradstreet, or Creditreform. These reports provide a credit score, payment history, liabilities, and any legal proceedings, offering a clear picture of the company's financial health.

Key Red Flags

- Hesitation or refusal to share the Ticaret Sicil Gazetesi, MERSIS, or VKN.

- A mismatch between the legal entity name and the bank account name.

- A registered address that points to a residential building or virtual office.

- A low credit score or a history of late payments detailed in a credit report.

Step 2: Certification and EU Compliance Verification

For European buyers, verifying compliance with product safety standards and emerging EU regulations is non-negotiable. A supplier's failure to comply can create significant legal and financial liability for the importer.

Product & System Certifications

Request and verify the following key certifications:

- Management Systems: ISO 9001 (Quality Management) is a strong indicator of a structured process. Also, check for ISO 14001 (Environmental Management) and ISO 45001 (Occupational Health & Safety).

- Product Compliance: CE Marking is a legal requirement for many products sold in the European Economic Area (EEA). Do not accept a CE mark without a supporting technical file and test reports from an accredited laboratory.

- Material Compliance: Verify compliance with directives like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) by requesting test reports.

Verification Instructions

Do not take PDF certificates at face value. To check if documents are genuine:

- Check the certificate number on the official website of the issuing certification body (e.g., TUV, SGS).

- Verify the laboratory that issued test reports is internationally accredited through national bodies like TURKAK or international databases like the IAF.

- Ensure the company name and address on the certificate exactly match the details in the Trade Registry Gazette.

Emerging EU Regulations

A forward-thinking supplier must be prepared for new EU laws. This is not just a compliance check; it is a critical stability check.

- CBAM (Carbon Border Adjustment Mechanism): For importers of goods such as iron, steel, and aluminum, suppliers must provide verified data on embedded carbon emissions. Since Turkey does not yet operate a national carbon pricing system, Turkish exporters cannot claim any domestic carbon price deduction. As a result, the EU importer will be responsible for paying the full CBAM certificate cost once the mechanism becomes financially active in 2026.

To prepare for this, many Turkish manufacturers—especially in the construction materials sector—now issue Environmental Product Declarations (EPDs). An EPD is a third-party verified report that quantifies the product’s life-cycle environmental impact, including CO₂ emissions per ton or per square meter. Because it provides transparent, standardized carbon data based on EN 15804 + A2 and ISO 14025, an EPD can serve as verifiable emission evidence for CBAM reporting.

If a supplier fails to provide accurate or verified data (such as an EPD), default carbon values—usually much higher—will be applied, making cooperation with that supplier financially disadvantageous.

- German Supply Chain Act (LkSG): This law requires companies to conduct due diligence on human rights and environmental risks in their supply chains. According to BAFA guidance, the LkSG applies a risk-based approach rather than using a formal list of high-risk countries. Turkish suppliers may nevertheless fall under scrutiny depending on their sector and operations, so German businesses often apply heightened review for suppliers in Turkey. If a Turkish supplier fails to meet LkSG standards, it may lose major German customers and cause cascading disruption. Their preparedness and documentation, therefore, are a key indicator of long-term stability.

Step 3: Production Capacity and Quality Management Assessment

The goal of this step is to evaluate if the supplier can consistently deliver the required volume and quality. This involves moving beyond documents to assess their operational reality.

Key Areas of Inquiry

- Production Metrics: Ask specific, quantifiable questions. "What is your daily output capacity for this product line?" and "What is your current production lead time from order to shipment?"

- Quality Management System (QMS): If the supplier holds an ISO 9001 certificate, specifically ask for documentation related to Clause 8.4, which governs the control of subcontractors. This is vital because it proves the supplier manages the quality of its own supply chain—a common risk area in international sourcing.

- State-Verified Capacity: Request the supplier’s TOBB Capacity Report, a state-validated document issued under the Union of Chambers and Commodity Exchanges of Turkey (TOBB). This report details yearly production capacity, machinery inventory, employee numbers, and capital structure. It is formally recognized by Turkish authorities for Investment Incentive Certificates, industrial registry, export/import quota applications, and official tenders, making it more than a “nice-to-have”—it is essential proof of a serious manufacturing operation.

The report is typically valid for two years and must be approved through both the local chamber and TOBB.

Signs of Over-Promising

- Vague answers like "we have high capacity" without providing specific numbers.

- Unrealistically short lead times compared to established industry standards.

- An inability to provide QMS documentation or explain their quality control process clearly.

Step 4: Factory Audit (On-site or Remote)

An audit's purpose is to validate that the factory physically exists and that its documented QMS is implemented effectively on the shop floor. It is the only way to confirm that claims match on-the-ground reality.

Audit Options

- On-site Audit: This is the "gold standard" for verification, whether performed by your own team or a hired third-party inspection agency. It provides the most comprehensive view of the supplier's operations.

- Remote/Virtual Audit: A cost-effective alternative, especially for initial screening. This involves a live video call where the supplier provides a real-time walkthrough of their facility.

Physical Indicators of QMS Failure

During an audit, look for physical signs that reveal deeper management weaknesses that documentation can hide.

- Production Area: Is it organized? Is machinery well-maintained with visible and current calibration tags? Neglected equipment points directly to potential production errors and quality inconsistency.

- Warehouse: Is the storage for raw materials and finished goods orderly, clearly labeled, and segregated? Unlabelled goods indicate poor inventory control.

- Quality Control Station: Are there visible QC checks being performed? Are there proper, calibrated measuring tools and standardized documentation (e.g., control sheets, inspection records)?

- Safety & Housekeeping: Poor housekeeping, such as cluttered aisles or employees lacking necessary PPE, is a sign of deeper management gaps and increased risk.

Critical Red Flags

- An empty facility or idle production lines during claimed operating hours.

- Unlabelled raw materials or finished products in the warehouse.

- Refusal to show certain areas of the factory, which can be a sign of hidden subcontracting.

- Poor housekeeping and obvious safety gaps, indicating deeper management failures.

Step 5: Communication and Transparency Evaluation

A supplier's communication quality before an order is placed is a strong predictor of their reliability when problems inevitably arise. This evaluation is a continuous assessment throughout the entire verification process.

Assessment Criteria

- Responsiveness and Clarity: Do they reply to emails within 24 hours? Are their answers direct, complete, and easy to understand?

- Technical Understanding: When you ask detailed technical questions, do you get clear, data-driven answers from an engineer, or does a salesperson have to "check with the factory" for every detail?

- Proactive Transparency: Do they voluntarily share information like production updates and documentation, or do you have to chase them for every piece of information?

- Cultural Context: Turkish business culture values strong personal relationships built on trust and patience. European buyers must approach negotiations with respect, recognizing that aggressive communication may be counterproductive. A supplier's direct, clear, and structured communication is a strong sign of professionalism and experience with European clients.

Communication Risk Patterns

- Inconsistent answers from different contacts within the company.

- Vague project timelines that lack clear, verifiable milestones.

- A defensive or hostile attitude when asked for standard documentation like certificates or audit reports.

Step 6: Reference and Track Record Verification

This step validates a supplier's credibility and export experience through their past performance, particularly with other European clients.

Verification Methods

- Request EU Client References: Ask for contact details of 2-3 current or past EU clients. Contact them directly to inquire about their experience with on-time delivery, product quality, documentation accuracy, and problem-solving.

- Review Export Documentation: Ask for sanitized sample copies of recent export documents, including commercial invoices, packing lists, and especially the A.TR Movement Certificate. Since 8 July 2024, EU member states accept electronically issued A.TR certificates (with QR codes) without a wet-ink signature.

It is critical to recognize what A.TR actually demonstrates: it certifies that the goods are in “free circulation” under the EU–Turkey Customs Union (i.e. all import formalities were cleared and any duties paid). However, A.TR is not proof of preferential origin. To establish origin under trade agreements or rules of origin, you may also need an EUR.1 certificate (or equivalent origin documentation) depending on the product and destination.

- Independently Verify Export History: Use specialized trade data services or online platforms to independently verify a company's shipping history, destination markets, and export volumes. This is a professional technique to objectively confirm their international experience beyond their own claims.

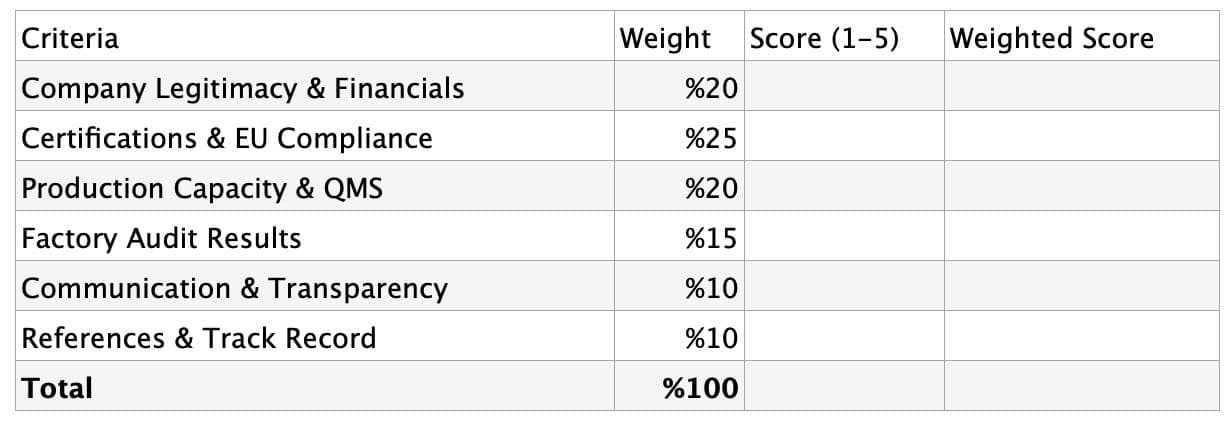

Step 7: Final Evaluation and Decision Framework

The final step is to synthesize all collected data into an objective, structured decision. This systematic approach avoids "gut-feeling" choices and creates a defensible basis for your selection.

Introduce the Scorecard

Create a simple, weighted Supplier Verification Scorecard to measure each candidate against your key priorities. This turns qualitative observations into quantitative data.

Sample Scorecard

Set Pass/Fail Thresholds

Establish a minimum overall score required for approval. More importantly, define non-negotiable failures. For example, a supplier should be immediately disqualified for failure to provide verifiable legal registration documents or evidence of critical safety violations, regardless of their overall score.

Document Everything

The entire verification journey—including all documents, audit photos, key email correspondence, and the final scorecard—must be documented. This creates a complete audit trail that supports your decision and serves as a valuable dossier for future reviews and internal compliance.

Conclusion: Trust is Earned Through Verification

Verifying a Turkish supplier is not a one-time task but the foundation of a continuous risk management program. By following this structured process, businesses move from assumption to fact, de-risk their international sourcing activities, and build the resilient, long-term partnerships necessary to thrive.

Trust is earned through verification, not assumption.

Looking for structured supplier verification support in Turkey? Learn more about ACTR’s approach at www.ac-tr.com.